Winter 2025 UK Property Market Report: Underlying Resilience

The market showed underlying strength despite uncertainty in the run-up to the Autumn Budget, with steady transactions and prices. Greater clarity now should help boost confidence and allow buyers and sellers to move ahead.

Inflation and interest rates

The Bank of England held interest rates at 4% in November, reflecting a cautious approach as inflation remains above target. Inflation came in marginally softer than expected, rising by 3.8% in the year to September. Forecasts suggest inflation will be a little lower by year end (3.6%) and more measurable improvement next year (2.4% by the end 2026)¹. While inflation remains elevated, some analysts still see a small chance of a Bank Rate reduction in December, though most economists now anticipate the next cuts to be in 2026, with two further 0.25 percentage point reductions across the year². Any extra improvement will be a relief to borrowers.

Mortgage rates edge higher after a period of stability

Mortgage rates remained steady following the Bank of England’s decision to hold interest rates in September but have since edged up very slightly. The recent decline in fixed mortgage rates came to an end at the start of autumn, with the average two-year fixed rate (75% LTV) rising from 4.1% in August to 4.2% in September, with a parallel increase in the five-year rate (4.1% to 4.2%) over the same period³. However, product choice remains broad: the number of mortgage deals dipped slightly below 7,000 in October, down from a 17-year high in September but well above the 5,495 available two years ago.

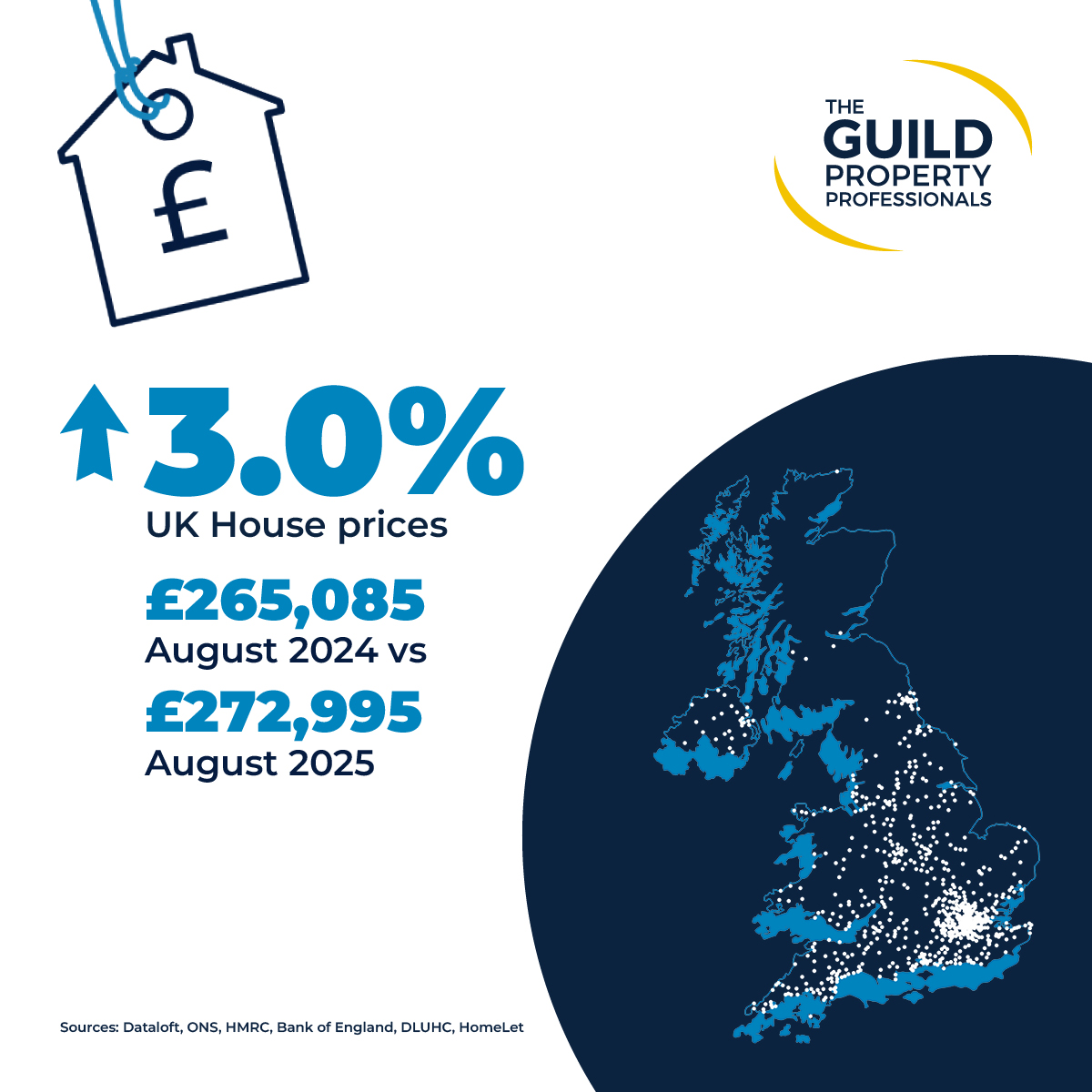

Resilient mortgage approvals

Mortgage approvals, an indicator of longer-term housing demand, have remained resilient despite wider political and economic uncertainty, helping to offset signs of caution elsewhere in the lead-up to the November Budget. In September, there were 65,944 mortgage approvals, just above the median forecast of 64,000 in a Reuters poll of economists. This figure is the highest since December 2024 and slightly above the long-term monthly average rate since 2012³. We are yet to see how the Budget will affect consumer confidence in the coming months, although greater certainty is typically positive for the housing market.

¹HM Treasury, Average of Independent Forecasts, October 2025, ²Reuters, ³Bank of England

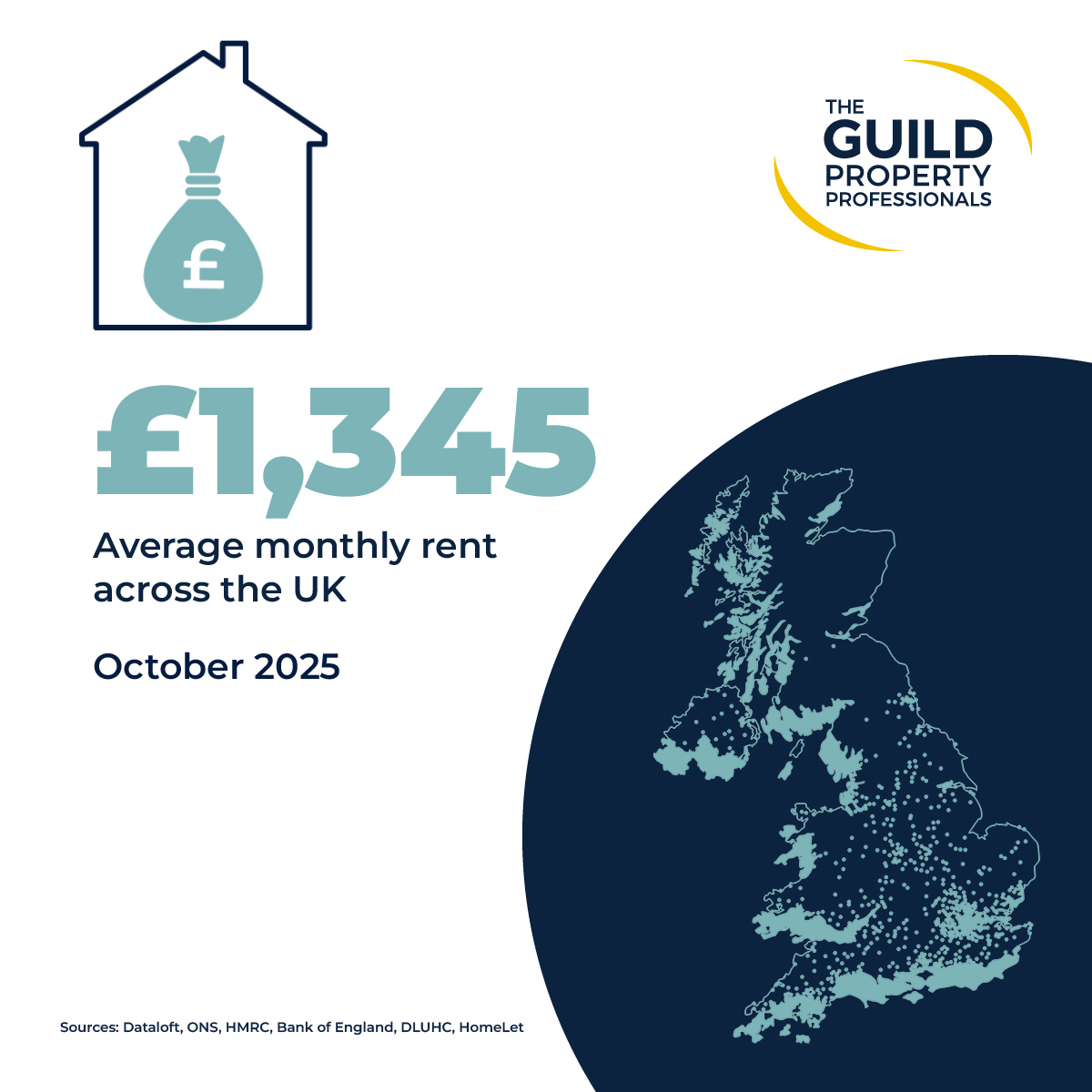

Rental market stabilises

As the market enters the winter months, rental activity typically eases from summer peaks, leading to a moderation in demand. After several years of sharp increases, rental growth is now easing as affordability pressures and an improving supply picture begin to help the market rebalance. Rental listings are up 6.9% on last year, though undersupply is still a market constraint as available stock remains 159,000 below 2019 levels¹. Annual UK rental growth stands at 1.4%, with the average rent at £1,345 per month. Regional trends vary, with Northern Ireland leading at 10.6% annual growth, while rents in Wales are unchanged year-on-year².

¹TwentyEA, ²Dataloft by PriceHubble, HomeLet

Browse all our Regional Market Reports here.

Contact us

Sell your property with your local expert this season. Contact your local Guild Member today.